Optimizing materials selection in automotive and aerospace structures

Advanced materials analyst Ross Kozarsky (Lux Research, Boston, Mass.) looks at composites and competing metals in the multimaterial car of the future.

In my role as an analyst who helps clients find new business opportunities in emerging technologies, I have scouted a wide range of advanced materials that span the “innovation funnel,” from the invention and prototyping stages all the way through production. For the automotive and aerospace markets, both of which are dynamically expanding, my firm has targeted several technologies: carbon fiber composites, nanocrystalline metals, such as magnesium, and — in my opinion, the dark horse — additive manufacturing.

First recognized and used in 1879 by Thomas Edison as the filament in light bulbs, carbon fiber is progressing along the development path. Since the advent of polyacrylonitrile (PAN) precursor in the 1960s, the application of high-strength carbon fibers has grown markedly, from sporting goods to aircraft structures to automotive chassis and body panels. At present, the cost of fiber prevents widespread adoption.

Absent an alternative precursor or faster, less-expensive thermal treatment technologies, fiber cost will gradually increase, due to rising operating expenses. But I believe that lower-cost fiber is possible in the near-term based on ongoing work by Oak Ridge National Laboratory (ORNL, Oak Ridge, Tenn.) in collaboration with SGL-The Carbon Co. (Wiesbaden, Germany) on textile-grade PAN precursors. In the long term, ORNL’s work with Ford Motor Co. (Dearborn, Mich.) and Dow Automotive (Auburn Hills, Mich.) on polyolefin-based precursors should yield more dramatic cost reductions.

As emerging technologies come online, in precursor, oxidation and carbonization, best-in-class carbon fiber costs will fall to around $11/kg ($5/lb) by 2017. With more competitive pricing, the total carbon fiber-reinforced polymer (CFRP) market will reach $36 billion by 2020, with aerospace at $14.4 billion and the automotive sector growing to $2.7 billion. Despite difficulties, lignin precursor-based carbon fiber will continue to receive attention, and I believe that CFRPs that employ thermoplastic resins will grow and be more widely applied.

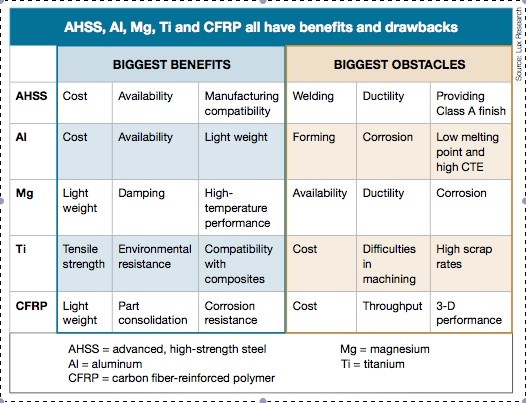

That said, those who deal in advanced metals are not watching idly as carbon fiber composites move to increase their share in aerospace and automotive — the metals industry also is innovating. Fig. 1, which illustrates a matrix of advanced metals and CFRP, demonstrates both the benefits and the obstacles to adoption of competing materials. Going deeper, a decision-tree, material-trade analysis of aerospace material selection for aircraft components shows that, for example, high-strength steel has an assured position in landing gear today, but titanium and carbon likely will grow in those applications. Aluminum will remain a strong contender in ribs, stringers and bulkheads, but carbon fiber and titanium are poised to take larger shares in that area. In the automotive sector, semistructural components, such as seats and instrument panel beams in the vehicle interior, represent a four-horse race, with steel, aluminum, magnesium and carbon fiber vying for dominance in future cars. I see carbon fiber taking some of aluminum’s share in powertrain parts that don’t need high thermal stability.

In reality, the car of the future will be a multimaterial construction in which composites and advanced metals will be combined to achieve the best performance/cost balance.

A material to watch, in aerospace and automotive, is nanocrystalline magnesium produced in sheets by nanoMAG (Livonia, Mich., a Thixomat company). The company uses a proprietary thixomolding thermal/mechanical process that converts billets to sheet form and is currently targeting high-value applications in defense, armor, aerospace and sporting goods, with the help of grants from the U.S. Army and others. This material could represent a kick to the gut for other structural materials, depending on its development and adoption.

Finally, additive manufacturing must be viewed as both a competitive and a complementary solution in many applications. This fascinating technology, which includes stereolithography (SLA), selective laser sintering (SLS), fused deposition modeling (FDM), 3-D printing and similar processes, can produce virtually any shape or feature, without much postform processing. The materials used in the processes include metals and polymers that have embedded functional fillers and/or chopped fibers. However, the processes do have cost, yield and scalability limits compared to incumbent subtractive manufacturing and require a strategic business model for commercial success that includes a focus on small, complex, high-value parts, such as components for gas turbine engines and orthopedic implants (see “Learn More,” below). Savvy developers will sell optimized raw material powders at high margins to enable part manufacturing. Manufacturers who need complex, high-temperature plastic or metal parts should consider engaging with one of the leaders in this growing sector.

RELATED CONTENT

-

Painting a Boeing 737: See The Video

The cost is between $100,000 to $200,000 to prep and paint each plane, depending on which colors are chosen, and how many colors.

-

Anodizing for Bonding Applications in Aerospace

Anodizing for pre-prep bonding bridges the gap between metallic and composite worlds, as it provides a superior surface in many applications on aluminum components for bonding to these composites.

-

A Protective Decorative Electrolytic Coloring Process for Aluminum

The main task of this work was to study the influence of the different parameters on the electrolytic coloring process for aluminum.