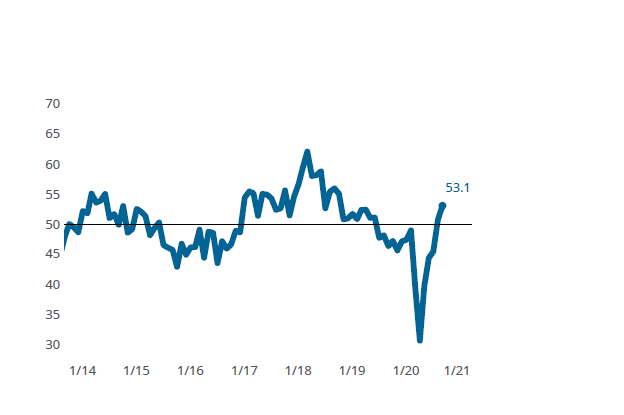

Finishing Index Reaches a Two-Year High in September

GBI’s Finishing Index has reported a second consecutive expansionary reading, signaling the continuing recovery of the finishing industry — but the report also contains supply chain readings that could stymie this recovery if left unaddressed.

#economics

The Gardner Business Index (GBI): Finishing moved higher in September to close at 53.1, marking a two-year high. Readings above 50 signal an expansion in economic activity compared to the prior month; the higher a reading is above 50, the greater the proportion of respondents reported increasing business activity. The latest reading therefore contained the highest proportion of finishers reporting month-to-month improving conditions since late 2018. New-order activity led the Index for a second month, with production gains following closely behind. September’s employment activity moved back into contractionary levels, but this was more than offset by an 8-point move in backlog activity, which marked its first expansionary reading since 2018.

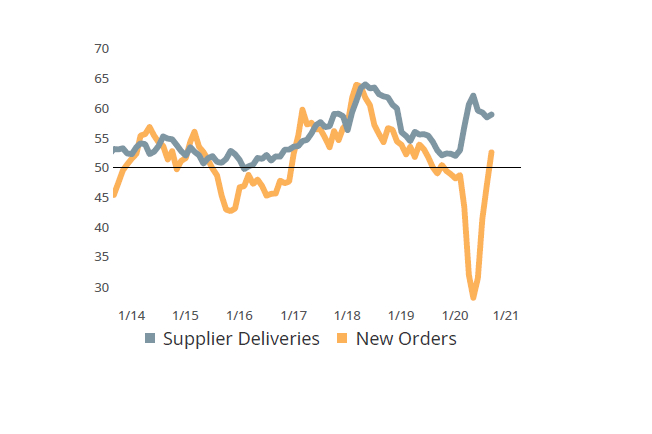

September’s impressive new-orders activity reading — the one-month reading was in excess of 58 — represents one of the strongest turnarounds in demand among the many manufacturing disciplines Gardner Intelligence tracks. As history has proven, new-orders directionally lead activity in most of the Index’s other components. That said, the ongoing disruption to the finishing industry’s supply chain could hinder this expansion moving forward. Supplier delivery readings continue at highly elevated levels, signaling that finishers are not receiving inputs at the desired quantity or frequency. It will take a combination of both improving demand and upstream supplies getting to finishers at desired levels for the industry to see continued expansion in the closing months of 2020.

Finishing Index

The Finishing Index reported not only its second consecutive expansionary reading in 2020, but also the highest reading since the fourth quarter of 2018.

New-orders activity leads index higher, but could supply constraints ruin further gains?

New-orders activity set a multi-year high, helping to send production and backlog activity higher. Further expansion may depend on upstream suppliers’ ability to keep finishers stocked with sufficient resources. This graph is based on a 3 month moving average.

RELATED CONTENT

-

Henry Ford Is Still Right When It Comes to Color

Who would have imagined that more than 100 years after his famous statement about any color as long as it’s black would still have relevance of a sort?

-

2020 Top Shops Benchmarking Survey Results for Electroplating & Anodizing

North American Market Shows Mixed Results for the 2019 Reporting Year

-

Hard Chrome Plating... Its Past, Present and Future

Providers of hard chrome electroplate, a relatively small but critical component of the overall chrome plating market, have endured tremendous stress and changing market forces in the past decade...

.jpg;width=70;height=70;mode=crop)