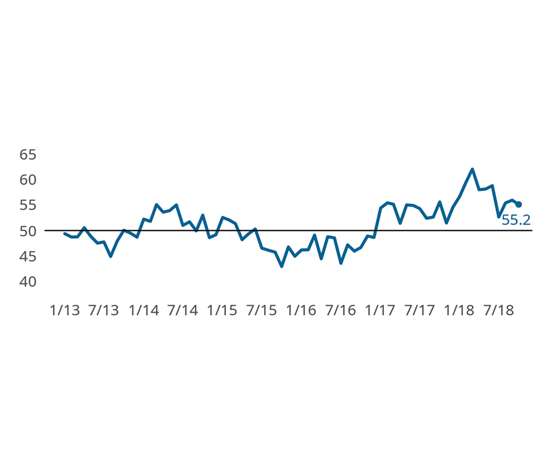

Supply Chain Expansion Powers Industry Growth

The Finishing Index was driven by supplier deliveries, production and new orders in October.

October’s Gardner Business Index: Finishing registered 55.2, keeping with the strong growth experienced in the prior months of the latest economic expansion. A review of the underlying components indicates that supplier deliveries, production and new orders drove the index higher, while employment, backlogs and exports pulled the index lower. Exports was the only index component that experienced contraction in October.

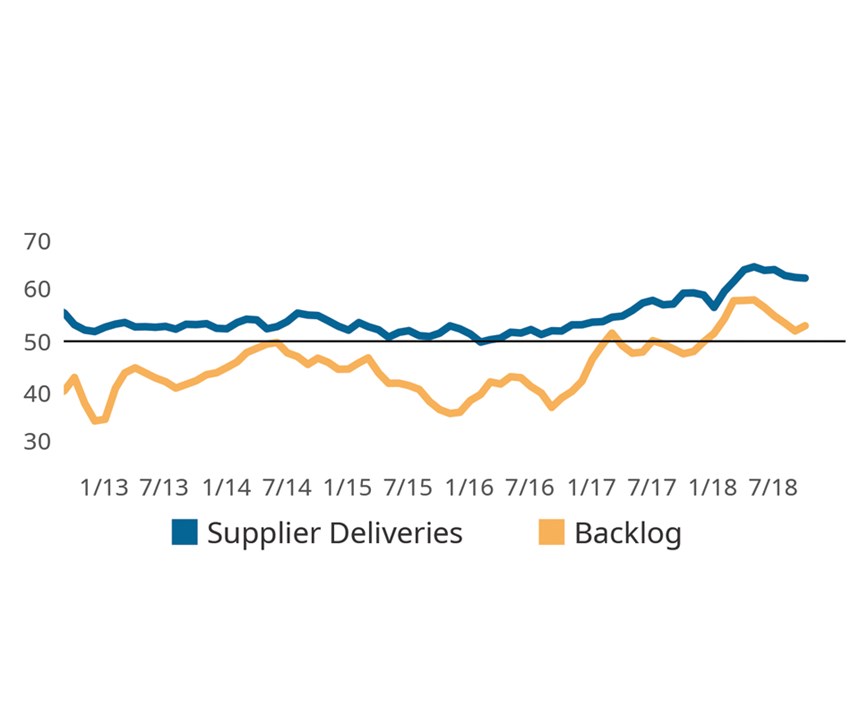

In the past six months, supplier deliveries have expanded at levels not previously experienced in the history of the Finishing Index. The upward trend in supplier deliveries expansion has lasted for more than 2½ years and set an all-time high during the second quarter of 2018. Prior to then, production and new orders had expanded at faster rates than supplier deliveries, which can ultimately result in supply chain constraints. Since May, supplier deliveries have expanded faster than those components, likely alleviating some of the backlog growth first realized in the fourth quarter of 2017. As suppliers continue to modify the supply chain supporting finishing shops, Gardner Intelligence expects future backlog growth to slow and production to increase.

Finishing exports continued to contract in October. Across many of the manufacturing industries that Gardner monitors, exports have experienced contraction during the second and third quarters of the year. The timing of exports contraction is consistent with the strengthening of the U.S. dollar against the currencies of some of America’s largest trading partners, including Canada, Mexico and China. The appreciation in the value the dollar has made U.S. exports comparatively more expensive, and thus less competitive, compared to the domestic production of foreign countries.RELATED CONTENT

-

An Introduction to Cyclic Corrosion Testing

A more realistic way to perform salt spray tests.

-

What is Electrocoating?

E-coat can produce uniform finishes with excellent coverage and outstanding corrosion resistance.

-

Building an E-coat Line from the Ground Up

How one company is prospering by providing flexible e-coat capability to Nissan and other customers.

.jpg;width=70;height=70;mode=crop)