Finishing Index Falls Slightly, Still Near All-Time High

Accelerating New Orders and Limited Production Send Backlogs Higher

Three months after setting a March all-time high, the Products Finishing Index remained in lofty territory with a June 62.1 reading. The latest reading is fewer than 2-points below March’s high. The June data registered accelerating activity in employment and steady export activity. New orders and production activity both posted slowing growth with production activity slowing more quickly. The widening spread between (total) new orders and production resulted in backlog activity reporting only slightly slowing expansion. Backlog readings in each of the last three months have exceeded the former all-time high reading from 2018 which occurred during the peak of the 2017-2018 cyclical expansion.

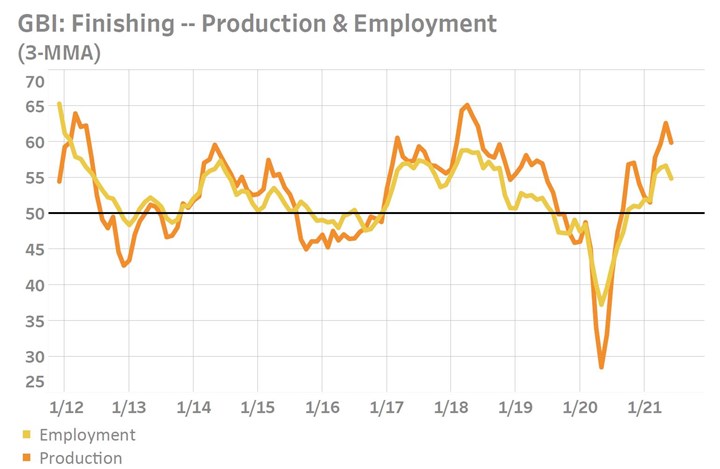

In past months’ reports, Gardner Intelligence has highlighted the unprecedented slowdown in order-to-fulfillment times (represented as rising supplier delivery readings) as one significant cause of underwhelming production activity readings. This reason alone however is incomplete as a tight labor market has starved many finishers of the employees they need to further boost production activity and meet surging demand. For much of 2021, finishers have reported difficulties in hiring additional labor, as evidenced by the spread between production and employment activity. Only in three other instances since 2011 has such an event occurred.

Products Finishing Index

The Products Finishing Index trended slightly lower for a fourth month; however, the Index remains fewer than 2-points from its most recent all-time high.

Challenging Hiring Conditions Undermine Production’s Expansion

The latest spread between employment and production activity in part explains rising backlog levels and the widening and prolonged gap between new orders and production readings.

.jpg;width=70;height=70;mode=crop)