Zinc-nickel plating is growing in popularity in Thailand for high-end automotive applications. ZinKlad 1000 represents the industry’s best answer to preventing corrosion.

Photo Credit: All photos courtesy of MacDermid Enthone Industrial Solutions

While cars have been manufactured in Thailand since 1961, production really began to rev up in the late 1980s. That growth was fueled by investments made by Japan-based manufacturers of cars and pickup trucks following an unrelated currency agreement made by the Group of Five (G5) in 1985. Decisive policymakers at Thailand’s Board of Investment (BOI) later laid out a plan in 2004 to further transform the country’s automotive industry from a loose collection of knock-down kit assemblers to a well-oiled ecosystem of locally-produced vehicles and, more importantly, parts. As seen in other more mature automotive markets, the in-country existence of plating job shops in Thailand has enabled both Tier 1s and Tier 2s to follow the automotive OEMs in entering the country and increasing local production.

Starting with kits

Completely Built Up (CBU) technology was the fastest way for Thailand to kickstart its automotive industry, and this quick-and-dirty manufacturing method did not require OEMs to build local factories. Completely Knocked Down (CKD) kits, however, quickly became the preferred way for foreign manufacturers of motorcycles, passenger vehicles, and pickup trucks to enter any new country which lacked the infrastructure necessary to assemble from scratch, and the same was true with Thailand during that period. At that time, CKD kits contained plated parts from Japan and other countries in Asia which had a more sophisticated surface treatment supply chain in place.

Featured Content

Rise and fall of local content requirements

Just 10 years into its infancy, the automotive industry had to comply with local content requirements (LCR) in 1971 of 25% or more, which led to Japan-based Tier 1s building factories in Thailand. By 1978, the government banned almost all CBU imports in order to encourage domestic assembly. Multiple tariff increases on CKD kits naturally accelerated the path to localized automotive production. Then, in 1984, the Thai government required that at least 54% of the content in a passenger vehicle be produced locally, which gave rise to the commercial plating industry in Thailand. By 2000, however, the Thai government had to abolish the LCR altogether to comply with promises made at the Uruguay Round of multilateral trade negotiations as part of the GATT (now WTO) regulations. Despite the sudden absence of local content requirements, the plating job shops in the Kingdom of Thailand were here to stay.

Currency manipulation

It would be remiss not to mention the historical event that guaranteed the continuation of Thailand’s automotive industry. Eight thousand miles away from Bangkok, the finance ministers and central bank governors of France, Japan, the U.K., the U.S., and then West Germany met in 1985 at the Plaza Hotel in New York City. These G5 members of the Plaza Accord agreed to manipulate the currency markets by intentionally depreciating the U.S. dollar against the world’s other reigning currencies of the time — the French franc, the German Deutsche Mark, the Japanese yen, and the British Pound sterling. The subsequent appreciation of Japan’s currency from 242 to 153 USD/JPY greatly benefited Thailand because the capital inflow from Tokyo — in the form of foreign direct investment — was used to build local factories by OEMs, Tier 1s, and Tier 2s. Thanks to this unintended result of the Plaza Accord, automotive-focused job shops in Thailand were able to use returns from the new business to invest more in electroplating equipment.

Detroit of Asia

The protectionism of the 1970s and 1980s in Thailand aided local parts suppliers and job shops, whether via strict LCR policies or high import tariffs on CKD kits, but never resulted in the creation of a dominant home-grown domestic player in the automotive market. Besides a lone Volvo-affiliated assembler in Thailand, all of the country’s OEM factories were owned by Japanese brands at that time. Shrewd policymakers at the Thai government then agreed to liberalize the market, which diversified the automotive industry by bringing in investments from Ford, Chrysler, and GM. The BOI wisely launched the so-called “Detroit of Asia Plan” in 2004, which aimed for Thailand to act as a regional hub of manufacturing in order to export fully assembled vehicles to car-hungry consumers in Indonesia, Malaysia, Singapore, and other Southeast Asian markets.

Industrial parks

Part and parcel of the government’s policy were to create industrial parks throughout Thailand so that strategically important industries could form a cluster for the benefit of all companies in the supply chain. Since properly developing the automotive industry in a country requires up to 30,000 parts and components, industrial parks play a significant role in allowing suppliers to accumulate knowledge and gain capabilities. For example, the Nava Nakorn Pathumthani Industrial Zone, founded in 1971 and located 30 miles north of Bangkok, is home to several automotive-related suppliers.

The Nava Nakorn Pathumthani Industrial Zone is home to SSI Surface Technology Co., Ltd., which occupies 100,000 square feet in this industrial park 30 miles north of Bangkok, Thailand.

Plating pioneer

A frontrunner in the Thai automotive plating industry is SSI Surface Technology Co. Ltd., which was established as a plating job shop in 1983 when local content requirement policies were near their peak. Before getting into the notoriously difficult-to-enter automotive industry, SSI plated spokes for use in bicycles first and later in motorcycles. The company was initially known as “Siam Spokes Industrial Co., Ltd.,” with the Siam name used in deference to the former country name of Thailand before 1949. “During the heyday of the bicycle era, SSI’s plated spokes were exported to countries such as Myanmar and Cambodia for assembly,” comments Suraporn Nuntamongkol, the 73-year-old Managing Director who started the company at age 33. Spokes play a vital role in the performance of both bicycles and motorcycles, so rust is absolutely not tolerated.

SSI uses fully-automated barrel plating lines to process fasteners with zinc nickel 24 hours a day, 6 days a week.

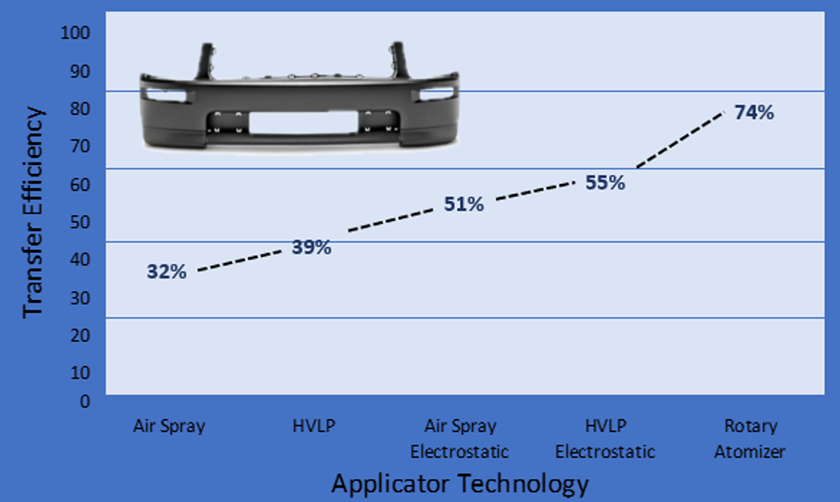

Located in the Nava Nakorn Pathumthani Industrial Zone, SSI is presently focused on serving the needs of the automotive industry within Thailand. More than 90% of its business is for plating automotive parts, with a majority of its 45 customers being tied to the Japanese automotive supply chain. This locally-owned job shop specializes in the anti-corrosion segment of the plating industry, with processes such as zinc and zinc-nickel plating available in either rack or barrel offerings. Nuntamongkol adds, “As the only ZinKlad 1000 certified applicator in Thailand, our customers can achieve exceptional corrosion resistance for parts such as high-end fasteners, brake calipers, and fluid transfer tubes.” (ZinKlad is a quality assurance program used by more than 90 platers in 18 different countries to ensure consistent results across components throughout the supply chain.)

Suraporn Nuntamongkol leads a team of 110 employees who work hard to provide world-class zinc and zinc-nickel plating to demanding automotive customers from Japan and other countries.

Talent acquisition and retention

A challenge faced by SSI and other Thai electroplaters is attracting talent to join this industry and then retaining them, a pain that is woefully shared by owners of job shops in the United States and other Western countries. While demographic conditions in Thailand are overall better than rapidly aging societies in most other countries, young Thais motivated by financial reasons often expatriate to other countries, so the pool of available talent in the manufacturing sector is limited. Employers in Thailand may choose to hire laborers from Cambodia, Laos, and Myanmar as citizens from those three neighboring countries seek better employment opportunities in the kingdom. SSI Surface Technology has filled the talent gap by employing highly skilled professionals from Myanmar on multi-year contracts for certain positions. The retention of its 110 employees, both Thai and Myanmarese nationals, has improved by offering excellent above-industry-standard benefits and using state-of-the-art scrubber systems, which reduce the odor on the shopfloor at SSI, creating a safer work environment.

Inspectors guarantee that every single fastener that leaves SSI is completely free of plating-related defects.

Continuous investment

Suraporn Nuntamongkol and his management team have been steadily importing automated plating equipment and related machinery from reputable vendors in Taiwan and other countries in order to grow the business without worrying about talent acquisition. Generous tax incentives encourage both Thai and non-Thai owners of factories to invest continuously in the technology which is needed to improve their competitiveness. Acquiring an automated visual inspection system, for example, is on the drawing board for SSI as they celebrate their 40th anniversary this year. Recent investments in wastewater treatment technologies continue to pay off for SSI and, at the same time, allow them to reduce their carbon footprint.

Future considerations

The current geopolitical tensions in parts of Asia may present new business opportunities to platers in Southeast Asia. Thailand, with deep ties to both Japan and the United States, also stands to profit from the increasingly popular “friendshoring” phenomenon whereby countries procure components from countries that share similar values. The kingdom’s pro-business policymakers have historically modified their foreign direct investment strategies to allow companies from any country to localize production in Thailand, especially in strategic industries such as the automotive sector. With the recent arrival of electric vehicle manufacturers, platers in Thailand will need to redefine their value proposition in the supply chain as the industry continues to mature going forward.

About the Author

Julian Bashore

Julian Bashore, based in Tokyo, is General Manager of the MacDermid Enthone Industrial Solutions businesses located in Indonesia, Japan and Thailand. He also manages the Circuitry Solutions vertical in Japan, and is a well-known figure in the printed circuit board industry where he has served on the board of the Japan Electronics Packaging and Circuits Association since 2015. Before joining the plating industry in 2013, his career was focused on coatings and other surface treatment technologies for both plastics and metals used in the automotive industry.

RELATED CONTENT

-

The Importance of Strike Solutions

Electroplating strikes are used to improve adhesion and create a foundation for subsequent layers when plating. In this helpful article, Adam Blakeley of MacDermid Enthone offers an insightful guide to understanding electroplating strikes.

-

Nanotechnology Start-up Develops Gold Plating Replacement

Ag-Nano System LLC introduces a new method of electroplating based on golden silver nanoparticles aimed at replacing gold plating used in electrical circuits.

-

Electroplating for Medical Devices

Brittany McKinney of Pavco Inc. discusses the benefits of electroplating for medical devices.