Industry Expands On Production, New Orders and Backlogs Activity

Weak employment and worsening supply chains drive “production deficit.”

#economics

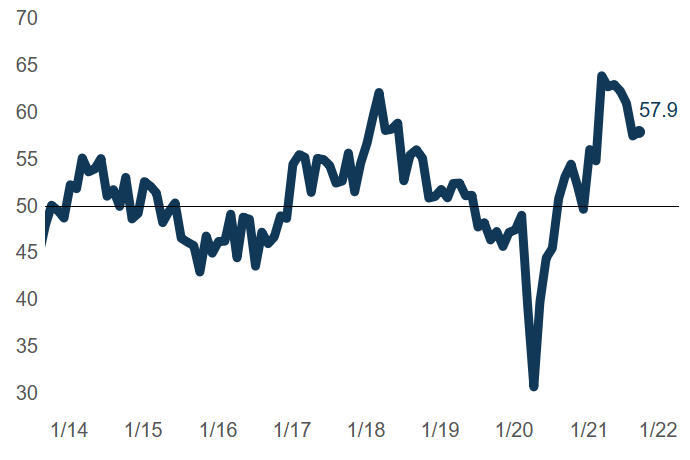

The Gardner Business Index (GBI): Finishing rose by a fraction of a point in September to close at 57.9. Contractionary readings for export orders and employment activity were offset by expanding activity readings for new orders, production, backlog, and supplier deliveries. September’s contractionary employment reading was the first of its kind since late 2020. In contrast, the reading for supplier delivery activity increased 1.5-points to match its all-time high from May. Recall that higher supplier delivery readings signal worsening supply chain performance.

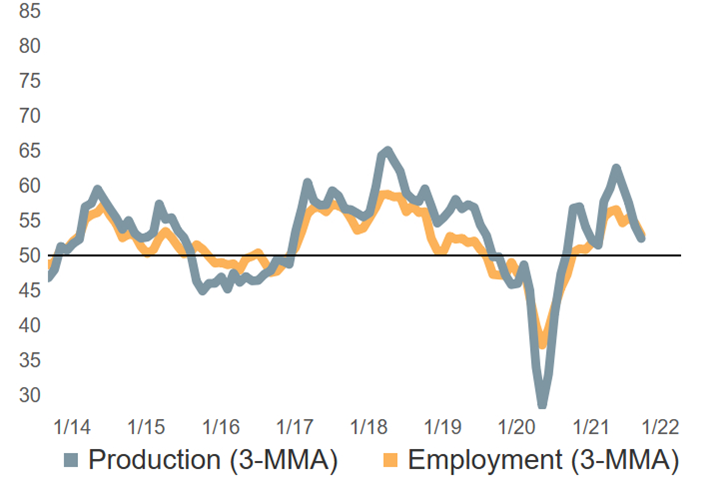

The end of the third quarter brought the problem of a diminished labor force into sharp focus for finishers as a scarcity of new hires resulted in contracting payroll activity. This was a dramatic shift from the summer’s readings when employment activity was at or near all-time highs. The current labor deficit coupled with the industry’s enduring supply chain problems has starved the industry of both materials and labor, sending production activity readings lower in five of the last six months. Simultaneously, relatively stronger new orders activity readings have caused a ‘production deficit’ that has sent backlog readings to record highs throughout much of the year.

Products Finishing Index

The Products Finishing Index inched higher during September to 57.9. Disrupted supply chains and a weak labor market severely impacted production in the third quarter.

Employment and supply chain challenges weaken production

The third quarter of 2021 witnessed a dramatic change in employment activity. Simultaneous supply chain and employment challenges have both curtailed production and inflated backlogs.

RELATED CONTENT

-

Powder Coating PVC?

Question: I have a product that I am trying to get to market.

-

Impact of REACH Regulation on the Global Finishing Market

This paper is a peer-reviewed and edited version of a presentation delivered at NASF SUR/FIN 2012 in Las Vegas, Nev., on June 12, 2012.

-

Automotive Powder Coating

The automotive market and its requirements for powders...

.jpg;width=70;height=70;mode=crop)